|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding FHA Loans in Bloomington, Indiana: A Comprehensive GuideWhat Are FHA Loans?FHA loans are a popular choice for many homebuyers in Bloomington, Indiana. These loans are insured by the Federal Housing Administration and are designed to help low-to-moderate-income borrowers purchase a home. With easier credit qualifications and a lower down payment requirement, they offer an accessible pathway to homeownership. Benefits of FHA Loans

Eligibility Criteria for FHA LoansTo qualify for an FHA loan in Bloomington, Indiana, borrowers must meet certain criteria: Basic Requirements

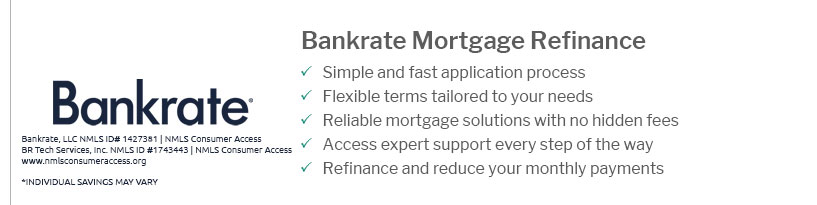

For those looking to refinance, exploring mortgage refinance options might be beneficial to find the best rates and terms. How to Apply for an FHA LoanApplying for an FHA loan involves several steps: Gather Necessary DocumentsBefore starting your fha loan application online, ensure you have all required documentation, such as proof of income, employment verification, and credit information. Find a LenderWork with a lender experienced in FHA loans who can guide you through the application process and ensure you meet all necessary requirements. FAQWhat is the minimum credit score required for an FHA loan in Bloomington?The minimum credit score required for an FHA loan is typically 580 for maximum financing, though some lenders may accept a score as low as 500 with a higher down payment. Can FHA loans be used for refinancing?Yes, FHA loans can be used for refinancing through the FHA Streamline Refinance program, which allows existing FHA borrowers to refinance with reduced documentation and underwriting requirements. Are there limits to how much I can borrow with an FHA loan?Yes, FHA loan limits vary by county and are determined by the Department of Housing and Urban Development (HUD). It's important to check the current limits for Bloomington, Indiana, when planning your purchase. Understanding the ins and outs of FHA loans can make the process of buying a home in Bloomington smoother and more affordable. With the right preparation, you'll be well on your way to securing your new home. https://www.iucu.org/mortgages-and-loans/home-loans/home-puchase-loans.html

Our home purchase options include fixed rate and adjustable rate mortgages, construction and jumbo loan financing. We also offer FHA loans and in-house low ... https://usavingsbank.com/get-started/bloomington-fha/

We believe in affordable FHA mortgage loans in Bloomington. At Union Savings Bank, we do everything we can to help families own a home. https://www.fha.com/lending_limits_state?state=Indiana

FHA mortgage lending limits in Indiana vary based on a variety of housing types and the cost of local housing. FHA loans are designed for borrowers who are ...

|

|---|